I've heard the collective groans from listing agents and selling agents when I tell them a buyer is pre-approved for a VA loan. But they're not as bad as you might think!

VA Non-Allowable Fees

First, sellers don't need to pay any additional fees when a buyer is getting a VA loan. Let me repeat that. There is no need for a seller to pay additional fees for a buyer who is getting a VA loan.

I know the NWMLS contract says the seller will pay up to $300 on FHA, USDA, and VA loans for fees the lender is not allowed to collect from the buyer. And there is an option for the seller to pay for the buyer's share of the escrow fee.

But the VA doesn't actually prohibit the buyer from ever paying an escrow fee.

For more on the exact VA rule, see below. Otherwise, trust me when I tell you that a lender should be able to structure a VA loan so that either the buyer/veteran or the lender can pay any fees the VA doesn't allow.

In fact, I recommend that REALTORS® include verbiage in a VA offer that says, "lender will pay any fees the buyer is prohibited from collecting under VA guidelines."

How long does it take to close?

In addition VA loans aren't taking any longer to close than other types of mortgage loans. It's true that there have been periods of time where VA transactions were taking six weeks or more. But those were different markets when all real estate transactions were taking longer to close.

That's not the case currently. The market has slowed, appraisers aren't as busy, and VA appraisals are arriving in a few weeks. In fact, we can easily close most VA loans in three weeks.

But what about appraisals?

VA appraisers are strict about repairs. That is true. Of all the VA loans I've originated in my time at New American Funding, 25% have required repairs.

But in nearly every VA loan I've originated, the repairs were minor and were remedied prior to closing or with an escrow holdback. The most common repair item? Peeling paint.

On VA loans, escrow holdbacks are your friend. Find out more about escrow holdbacks here.

What's the "long answer" about VA non-allowable fees?

The VA designates certain "non-allowable" fees including:

- loan closing, escrow, or settlement fees

- document preparation fees

- interest rate lock-in fees

- notary fees

- loan application or processing fees

- tax service fees

- real estate commissions

The VA also allows the lender to charge up to 1% in origination fees. If the lender charges that 1%, he can't also charge any of the non-allowable fees above. The lender must use the 1% charge to pay those fees.

But if the lender doesn't charge the buyer that 1% fee, the buyer can pay those non-allowable fees, up to 1% of the loan amount.

Clear as mud?

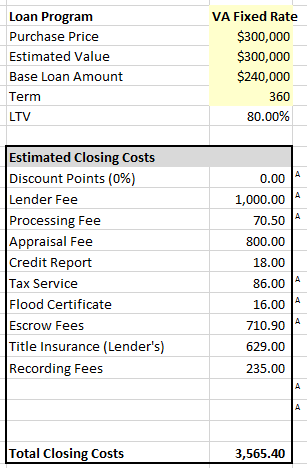

Look at the example below. I'm charging 1% of the loan amount as an origination fee (aka lender, processing, or administration fee; it's all the same thing). Therefore, I can't charge an additional processing fee, tax service fee, or escrow fee. I'll have to cover those costs out of my $2,400 lender fee.

Now check out the next example. I'm charging $1,000 for my lender fee. That means I can collect up to $1,400 (1% total) in non-allowable fees. My non-allowable fees are the processing fee, tax service, and escrow fees for $867.40. This is acceptable.

Did you say real estate commissions?

Yes! The VA prohibits veterans from paying real estate commissions on their home purchase. 99 times out of 100, that's not an issue because the seller is paying the real estate commission. But if you are in a situation where the buyer has agreed to pay a portion of your commission, you'll definitely want to keep this in mind!

We'll also be watching the aftermath of Burnett vs NAR et al closely. It will be interesting to see if this lawsuit has an affect on real estate commissions in general and VA loans specifically in the coming months and years.

The bottom line... If you have a seller who is considering a VA buyer but doesn't want to pay the additional fees, talk to your lender. The lender should be able to structure the loan so the buyer (or the lender) can pay the VA non-allowable fees.