I'm going to share a secret: Most lenders have approximately the same interest rate for most home loans. Why? Individual banks and mortgage companies don't determine the interest rates every day. The market does.

So my interest rate for a Fannie Mae 30-year fixed rate mortgage should be pretty similar to the bank down the street and the credit union across town. There are exceptions, which I'll tell you about in a sec.

Nevertheless, you have many lenders to choose from. How do you make sure you're getting the best interest rate possible?

What if you were shopping for a car instead of a mortgage? You've shopped online. You've done your research. And you know a fair value for the car you're interested in is $23,000. You go to three dealerships, and they all quote you somewhere between $22,000 and $24,000 for the car. At the fourth dealership, they offer to sell you the same car for $15,000. What would you think?

You'd probably think something was wrong, right? Maybe the car has been in an accident. Maybe there is a mechanical issue.

Use the same skepticism when applying for a home loan. If three different lenders quote you interest rates between 6.25% and 6.5% for the same price, and lender number four quotes you 4.5%, something is probably wrong. That lender may charge more in discount points, the loan could be an adjustable rate, or they might tack on lock extension fees at the end.

Remember, banks and mortgage companies have a range of interest rates available every day at different prices.

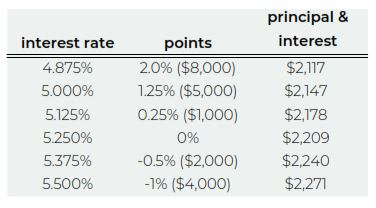

For example, today's interest rates options could look like this for a $400,000 loan amount:

In the above example, is it worth it to pay $8,000 to get a 4.875% interest rate? If you're short on cash, are you willing to accept a higher payment in exchange for a lender credit?

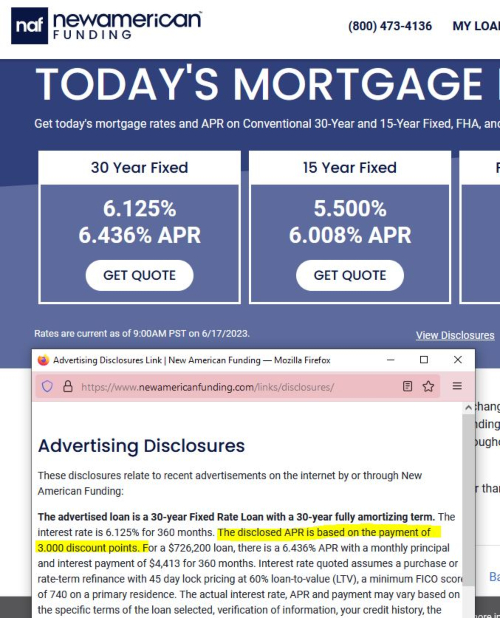

Sometimes, when you see an uber low interest rate advertised, it's because it comes with a higher cost. Read the small print.

In the advertisement above, New American Funding is advertising an interest rate of 6.125% with 3.0% in points. That's a $12,000 charge for the interest rate on a $400,000 mortgage.

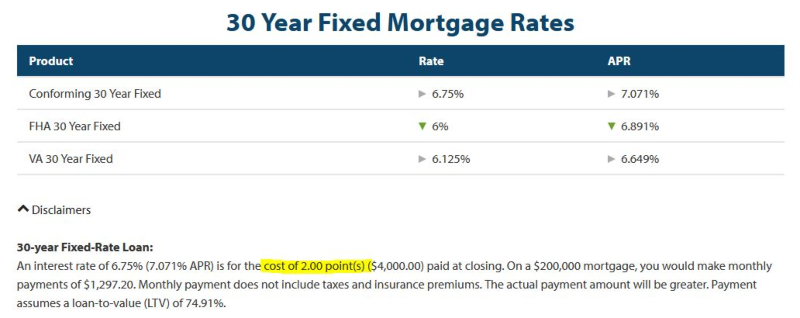

Compare that to this advertisement from Quicken Loans.

While NAF's advertised rate of 6.125% is much lower than Quicken's advertised rate of 6.75%, it also comes with a higher cost. To truly compare interest rates between the two companies, you'd need to compare costs for the same interest rate.

And ultimately you get to choose! Your lender should allow you to decide whether you pay discount points and how much you're willing to pay.

Interest rates are locked for specific periods of time - usually 30, 45, or 60 days. The longer the lock, the greater the cost. Make sure your interest rate lock doesn't expire before your closing date. What happens if you need more time? Can the lock be extended? What is the cost for extending? And who covers that cost - the lender or you?

Don't get so consumed with your interest rate that you don't pay attention to other potential red flags. It doesn't matter if your lender is offering you an interest rate that is 0.25% less than the competition if he can't get your loan closed on time and you lose the house to a back-up offer!

Really want to work with Acme Mortgage but think you could get a better deal at Loans-R-Us? Get a written estimate from the competition, and see if Acme can beat it.

The price paid (in discount points) for a particular interest rate changes every day - sometimes multiple times a day. A quote from Lender A on Monday can't be compared to a quote from Lender B on Wednesday!

Interest rates also depend on something called risk based pricing. Essentially, the GSEs (Fannie, Freddie, and government entities) charge more for riskier loans. For instance, someone with a credit score of 620 will pay more for the same interest rate than someone with a credit score of 740. A person buying an investment property will pay more than someone who is purchasing a primary residence.

Make sure your lender has a realistic picture of your specific scenario including property type, credit score, occupancy, and down payment. You're not doing yourself any favors if your lender is quoting you an interest rate for a stick built home and you plan to purchase a manufactured home.

Can you get a better interest rate somewhere on the Interwebs? Maybe. But you also get what you pay for.

I am like the valet parking of mortgage lending. I will drive the car for you. I'll give you directions to the venue. I'll hold the door for you. And I'll recommend a restaurant nearby. I am a professional and this is my career.

You can risk self-parking if you're up for it. But you'll have to drive around the block several times. Your car will get a little banged up. And you'll be ten minutes late for your event.

I said that most home loans have similar interest rates. That is correct for loans with a large secondary market (Fannie Mae, Freddie Mac, and government loans).

All of that flies out the window when we're talking about non-saleable mortgages: Alt-A or non-QM loans, jumbo loans, home equity lines of credit, land loans, and construction loans. Why? Because when we're talking about FHA loans, we're all selling the same product. (With a few exceptions), my FHA loan looks like the FHA loan from the lender down the street. And because I'm going to sell my FHA loan on the secondary market just like the lender down the street.

Non-saleable loans are often held in a lender's portfolio or sold to a much smaller secondary market. So guidelines, rules, and interest rates vary considerably from one lender to the next. Bank A might charge 4.5% for their jumbo loan. And Bank B might charge 6.5%. For non-saleable loans, it really pays to shop around!